So much for “no bailouts.” It turns out we are on a trajectory to make the 2008 financial bailouts look like child’s play.

Last week, banks borrowed $164.8 billion from the Federal Reserve in the face of the liquidity crisis affecting the security of deposits across regional banks. For comparison, during the most acute phase of the 2008 financial crisis, banks tapped $110 billion in short-term emergency loans the Fed refers to as the “Discount Window,” which is slightly less than last week’s run, even adjusted for inflation. Guess what this means? After a brief hiatus of less than a year, we are headed back into the era of printing more money.

In the most disastrous economic policy in American history, the Trump administration, Congress, and the Federal Reserve injected trillions in fiscal stimulus, artificially lowered interest rates to near zero, and grew the balance sheet of the Federal Reserve by $4.7 trillion in 2020. That would have caused insurmountable inflation even if it was used to invest in World War II-level infrastructure, but it was literally flushed down the toilet to fund a shutdown. This created the worst supply chain crisis throughout every sector of the economy – a crisis we are still feeling to this very day. In turn, we experienced a dynamic of too much money chasing too few goods to a degree we’ve never experienced before.

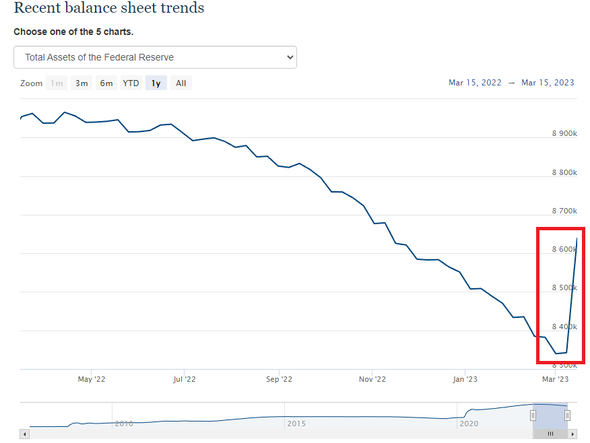

Last year, in response to the crushing inflation, the Federal Reserve acted like a drunk truck driver jerking the steering wheel wildly back and forth while on an open, windy bridge. Officials rapidly raised interest rates after the banking system relied upon the easy money for life support. They tightened the money supply and off-loaded about $600 billion of their nearly $9 trillion balance sheet. Well, that caused the truck to flip over, and now we are sitting on a financial crisis that could rival the banking meltdown of 2008.

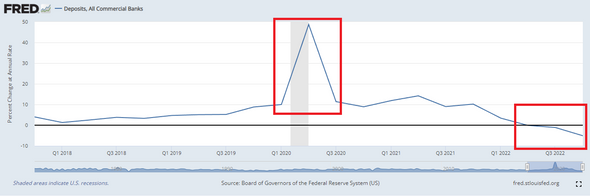

After inducing a gush of capital into commercial bank deposits during the COVID money-printing scheme, the same Fed then choked off the spigot, causing capital shortages. What goes up must come down. And now many banks are below their minimum thresholds for deposits.

Now the Feds are again so panicked about a monetary plumbing problem that they grew their balance sheet by $300 billion last week. In other words, they bought back overnight half of what they off-loaded during the quantitative tightening for almost a year.

$300 billion is a ton of money. Remember, the entire TARP bailout of 2008 was $700 billion. Yet the Federal Reserve and the Biden administration refuse to communicate with the American people what exactly they plan to do and how they plan to fulfill the promise of essentially guaranteeing all bank deposits without creating an inflation crisis that will invoke nostalgic feelings about 2022 as if it was an era of consumer empowerment.

Clearly, this crisis is much more systemic and global than they made it out to be, and Silicon Valley Bank was just the tip of the iceberg. To illustrate the historic nature of this banking crisis created by the erratic vacillation of COVID-era fiscal and monetary policy, historic Swiss bank Credit Suisse, which was one of the only banks that weathered the 2008 crisis without a bailout, had to be rescued by UBS after it lost most of its value. UBS itself is getting help from both the Swiss government and Swiss National Bank. USA Today reports that 186 more banks are at risk of failure, which is further inducing a panic for people to withdraw their funds and go with the big banks, like JPMorgan Chase, Citigroup, Wells Fargo, and Bank of America.

In other words, while central banks around the world induce a massive inflation crisis, the endless market tinkering by central banks and governments will result in what they always enjoy doing: namely, consolidating market share into a smaller and smaller monopoly at the top of the food chain. Banking is rapidly becoming like health care and farming. Government created this crisis across the spectrum of banking, but will, of course, be more tendentious in assisting the larger banks while letting the smaller ones fail. Thus, we will suffer economic collapse from all the banks going under and consolidated ESG tyranny from fewer options reserved to the elite institutions, but at the same time we will languish under the inflation of the loose money policies needed to keep the monetary plumbing functioning for the larger banks.

At this point, the Federal Reserve is the single biggest engine for woke capitalism and growth of government, aka economic transformation without representation. The purpose of the Federal Reserve is to grow woke and weaponized government on the cheap without the people feeling it directly with tax increases, as well as creating asset bubbles and artificial monopolies on behalf of its well-connected investors. The Fed is empowered to do what the elected officials are too cowardly to do without facing the voters. Remember, all this back-door spending is happening during a so-called debt freeze because we hit the debt limit.

Ending the ability of the Federal Reserve to tinker with the economy by repealing Humphrey-Hawkins would force the government to come directly to the people and ask for tax increases in order to fund the woke, weaponized, and welfare state. Unless we severely diminish the role of the Federal Reserve, the rallying cry of our revolution – “no taxation without representation” – will have been for naught.

Post a Comment