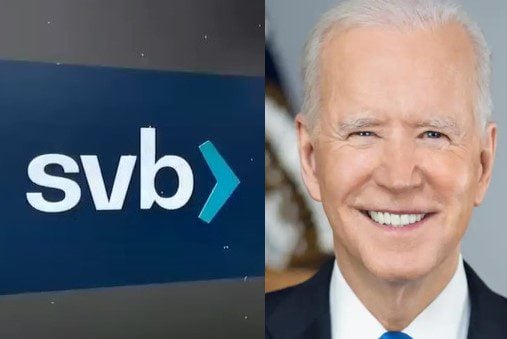

Joe Biden left out a very important point this morning about the bailouts he and his Administration are taking to rescue the Silicon Valley Bank.

Biden lies through omission.

This morning Joe Biden tried to reassure the nation about the banking segment of the economy as his Administration announced over the weekend that it was bailing out two banks – Signature Bank and Silicon Valley Bank.

Biden looked simply horrible as he slurred his words and mumbled through his short talk about bailing out these two banks. While he was speaking Western Alliance Bank dropped in value.

According to CBS:

Mr. Biden reiterated during his remarks that “no losses will be borne by the taxpayers,” and said the money will instead come from fees that banks pay into the Deposit Insurance Fund.

What Biden did not share (his lie of omission) is that the US government is bailing out Chinese venture capitalists who had a significant amount of deposits in SVB.

Last night we reported that the South China Morning Post noted the bridge between SVB and China.

The collapse of Silicon Valley Bank (SVB) has created a sense of panic within China’s tech start-up and venture capital (VC) sector, as the lender served as a bridge between US capital and Chinese tech entrepreneurs.

As of Sunday afternoon, topics related to the collapse of the bank, including “SVB bankruptcy has spread to multiple countries” and “SVB bankruptcy affects Chinese entrepreneurs”, were trending on Chinese microblogging site Weibo, with posts receiving hundreds of millions of views.

“Is the 2008 Financial Crisis happening again?” said a Weibo user with the handle MaxC.

China is the second largest venture capital market and SVB was right in the middle of it according to Tech Crunch.

China, the world’s second-largest venture capital market. Across social media platforms, investors and startups are rushing to share news articles on the fiasco and thoughts on how to prevent such a catastrophic moment. For some companies, however, the impact is tangible.

When China was still new to venture capital in the late 1990s, SVB was among the first financial institutions to start serving the country’s startups, while traditional, risk-averse banks avoided them. Over time, the bank has become a popular option for China-based startups fundraising in USD as well as some China-focused USD venture capital firms.

What Biden left out is that the US is covering for his CCP buddies and their venture capital business seeking USDs.

Post a Comment