President Joe Biden tried to give Americans "the facts" about how the Inflation Reduction Act stops big corporations from skirting tax laws.

But he was quickly fact-checked by Twitter for pushing a misleading claim.

What did Biden claim?

On Friday, the president claimed that 55 corporations that earned over $40 billion in revenue in 2020 failed to pay taxes, a problem the Inflation Reduction Act allegedly rectifies.

"Let me give you the facts. In 2020, 55 corporations made $40 billion. And they paid zero in federal taxes," Biden wrote on Twitter. "My Inflation Reduction Act puts an end to this."

The Inflation Reduction Act — which does not actually reduce inflation — imposes a minimum 15% tax on companies that, on average, earn more than $1 billion per year. According to Bloomberg Tax, the provision is "designed to prevent the largest corporations from exploiting tax loopholes that allow them to pay little or no federal income tax."

Moreover, the Joint Committee on Taxation estimated that only 150 companies will be subjected to the tax.

What did Twitter do?

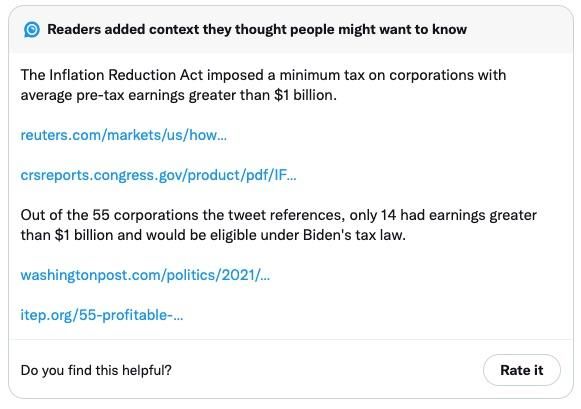

Twitter included a fact-check on Biden's tweet added by members of Birdwatch, the platform's "community-based approach to misinformation."

The information blurb pointed out, "Out of the 55 corporations the tweet references, only 14 had earnings greater than $1 billion and would be eligible under Biden's tax law."

Indeed, Biden's often-cited statistic is based on a report from the left-leaning Institute on Taxation and Economic Policy. The report claimed 55 corporations paid zero in federal taxes despite having earned collectively more than $40 billion in 2020.

But that figure is misleading because, as the Twitter blurb noted, only 14 of those companies earned more than $1 billion that year and thus would be subjected to the corporate tax imposed by the Inflation Reduction Act.

Ironically, the Washington Post fact-checked the claim last October and mostly absolved the president of pushing misleading claims.

"This '55 corporations' number is probably in the ballpark but readers should be aware that it’s not based on actual tax returns but instead is an estimate of taxes paid based on corporate reports," that fact-check concluded.

Post a Comment